PayAttitude is a mobile payment solution that allows businesses to accept payments from customers using their mobile phones. It is a convenient and secure way for customers to pay for goods and services, and it can help businesses to increase sales and reduce costs. In this article we are going to talk about how to use pay attitude for your business and how to maximize the features.

What is Pay Attitude?

PayAttitude is a Nigerian payment solution that allows customers to make payments and withdrawals using their phone numbers. It is a convenient and secure way to pay for goods and services, and can be used at ATMs, POS terminals, and online. PayAttitude is owned by a consortium of leading Nigerian banks, and is licensed by the Central Bank of Nigeria.

Benefits of Using Pay Attitude for Your Business

Pay Attitude is a payment solution that offers a wide range of benefits to businesses of all sizes. It is a convenient, secure, and affordable way for businesses to accept payments from their customers.

Here are some of the key benefits of using Pay Attitude for your business:

- Increased sales: Pay Attitude makes it easy for customers to pay for your products and services, even if they don’t have cash on them. This can lead to increased sales for your business.

- Reduced costs: Pay Attitude is a very affordable payment solution, with no hidden fees or charges. This can help to reduce your overall business costs.

- Improved efficiency: Pay Attitude can help to improve the efficiency of your business operations by streamlining your payment processing. This can free up your time and resources to focus on other important aspects of your business.

- Enhanced customer satisfaction: Pay Attitude is a secure and convenient way for customers to pay for goods and services. This can lead to improved customer satisfaction and loyalty.

In addition to these general benefits, Pay Attitude also offers a number of specific benefits for businesses in different industries.

For example, in the retail industry, Pay Attitude can help businesses to reduce queue times and improve the overall customer experience. In the hospitality industry, Pay Attitude can help businesses to process payments quickly and efficiently, even during busy periods. And in the e-commerce industry, Pay Attitude can help businesses to increase their conversion rates and reduce cart abandonment.

Overall, Pay Attitude is a versatile and affordable payment solution that can offer a wide range of benefits to businesses of all sizes.

How to Get Started with Pay Attitude

Pay Attitude is a Nigerian payment scheme that offers a variety of innovative technologies for payments and financial transactions, with a focus on mobile and digital payments. It is owned by a consortium of leading Nigerian banks, and is designed to make it easier and more convenient for businesses of all sizes to accept payments from their customers.

To get started with Pay Attitude for your business, you will first need to create an account. This can be done online or by visiting a Pay Attitude partner bank. Once you have created an account, you will be able to choose from a variety of payment processing solutions, including:

- Pay Attitude Digital: This solution allows your customers to pay you using their mobile phones. They can do this by downloading the Pay Attitude app and linking it to their bank account. Once they have done this, they can make payments to you by simply entering your phone number and the amount they wish to pay.

- Pay Attitude POS: This solution allows you to accept payments from your customers using a point-of-sale (POS) device. Pay Attitude POS devices are available from a variety of vendors, and can be used to accept payments from both chip-and-PIN and contactless cards.

- Pay Attitude ATM: This solution allows your customers to withdraw cash from their bank accounts using their mobile phones at any Pay Attitude ATM.

Once you have chosen a payment processing solution, you will need to integrate it with your existing business systems. This is usually a relatively simple process, and Pay Attitude provides detailed documentation and support to help you get started.

Once you have integrated Pay Attitude with your business systems, you will be able to start accepting payments from your customers.

How to set up Pay Attitude for your business

PayAttitude is a mobile payment solution that allows businesses to accept payments from customers using their mobile phones. It is a convenient and secure way to pay for goods and services, and it is becoming increasingly popular in Nigeria.

To set up PayAttitude for your business, you will need to create an account on the PayAttitude website. Once you have created an account, you will need to add your business information and banking details. You will also need to choose a payment method. PayAttitude offers a variety of payment methods, including bank transfer, debit card, and credit card.

Once you have set up your PayAttitude account, you can start accepting payments from customers. To do this, you will need to generate a PayAttitude payment link. You can share this link with your customers via email, SMS, or social media. When a customer clicks on the link, they will be redirected to the PayAttitude website, where they can make their payment.

How to Use PayAttitude to Accept Payments

PayAttitude is a Nigerian payment platform that allows businesses to accept payments from their customers using their phone number. It is a convenient and secure way to make and receive payments, and it is becoming increasingly popular among Nigerian businesses.

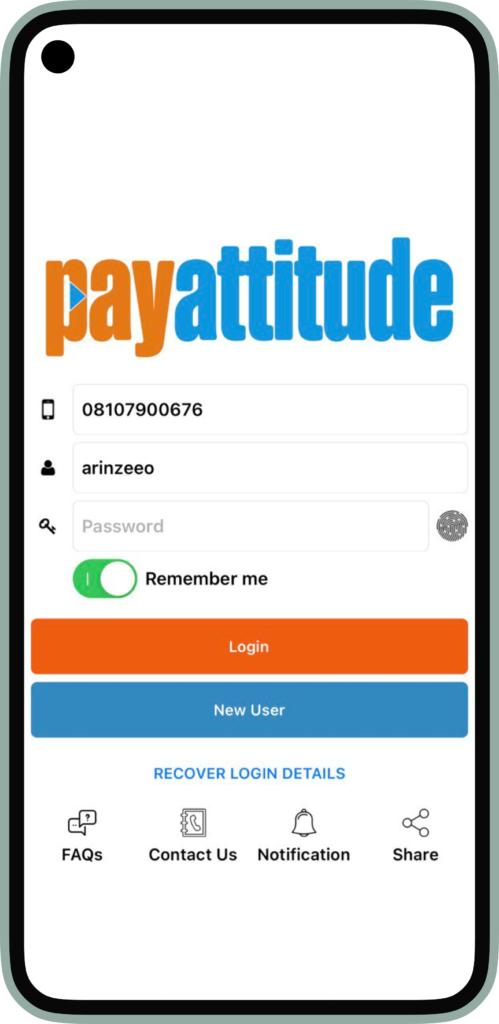

To use PayAttitude to accept payments, businesses must first create a PayAttitude account. This can be done online or through the PayAttitude mobile app. Once an account has been created, businesses can start accepting payments from their customers by sharing their PayAttitude phone number with them.

Customers can make payments to PayAttitude businesses using their phone number and a PIN. To do this, customers simply need to dial the PayAttitude phone number and enter their PIN when prompted. They will then be asked to enter the amount of money they want to pay and the phone number of the business they are paying. Once the payment has been authorized, the business will receive the payment instantly.

PayAttitude is a popular choice for Nigerian businesses because it is convenient, secure, and affordable. It is also easy to use for both businesses and customers.

How to Use Pay Attitude to Pay Employees and Vendors

Pay Attitude is a mobile payment platform that allows businesses in Nigeria to pay employees and vendors quickly, easily, and securely. It is a convenient and affordable way to pay your workforce, even if they do not have a bank account.

To use Pay Attitude to pay employees and vendors, you will need to create an account and link your bank account to it. Once your account is set up, you can easily send payments to your employees and vendors by entering their phone numbers and the amount you want to pay. The recipient will receive a notification on their phone and will be able to approve the payment with a simple PIN.

PayAttitude vs. Other Payment Solutions

PayAttitude is a unique payment solution that offers a number of advantages and a number of features that are not available with other payment solutions, including:

- Convenience: PayAttitude allows customers to pay for goods and services using their phone number, which is something that most people already have memorized. This eliminates the need to carry around cash or credit cards, and it makes it easy to pay for things even when you don’t have your phone or wallet with you.

- Security: PayAttitude uses a variety of security features to protect customer data, including encryption, tokenization, and fraud detection. This means that customers can be confident that their financial information is safe when they use PayAttitude.

- Withdraw cash from ATMs without a card: PayAttitude customers can withdraw cash from any ATM that accepts PayAttitude, without the need for a card. This is a very convenient feature for people who don’t have a bank account or who don’t want to carry around their debit card.

- Send and receive money using a phone number: PayAttitude customers can send and receive money to and from other PayAttitude users using only their phone numbers. This is a very fast and easy way to transfer money, and it is especially convenient for people who live in different countries.

- Use a phone as a POS terminal: PayAttitude businesses can use their phones as POS terminals to accept payments from customers. This is a very affordable and convenient way to accept payments, especially for small businesses.

Conclusion

PayAttitude is a convenient and secure mobile payment solution that can help your business in many ways. It allows your customers to make quick and easy payments without having to carry cash or cards, and it can help businesses to improve their customer service and increase their sales. It also reduces the risk of fraud and theft, as payments are processed electronically.