CAC ANNUAL RETURN ONLINE FILING IN NIGERIA

What is CAC Annual return? You might have been hearing from corporate consultants about cac annual returns, and keep wondering what is Cac annual return? well an Annual return is a statutory in Nigeria with corporate affairs commission, it is a yearly monetary payment undertaken by every registered business name, limited liability company or NGO in Nigeria within a specific calendar year to the corporate affairs commission.

This statutory procedure taken by every registered business name, company or incorporated trustee is carried out by lawyers, accountants and chartered secretaries.

The benefit of annual return is that it serves as a reminder and an evidence to the commission that the business, company or the entity is still in operation.

if there is any change in the management of the company, or change in the address of the company, or change in the objectives of the company or NGO, the commission expects the registered business to first file for an annual return for that year before it can make those changes.

An annual return is filed within the cac calender year, accordingly cac calendar year for annual return ends on 30th June of every year.

Business name annual return filing – the timeline for annual return for registered business name is within 18months of the registration of the business, subsequently each annual return is expected to be filed within the specific calendar year.

Annual return for limited liability companies: the annual return for limited liability company is expected to be filed within 42 days after the Annual general Meeting.

Annual return for incorporated trustees: annual return for Incorporated trustees such as foundation, Club, Church, Association, Organizations is done between 30th June and 31st December for the preceding financial year. NOTE: Companies and Allied Matters Act, 2020 Section 862.

HOW TO FILE AN ANNUAL RETURN WITH CAC ONLINE IN 2024:

we are providing you a guideline to file your annual return for business name or limited liability company in Nigeria in 2024

a. Go to https://post.cac.gov.ng/

b. create an account if you are already an accredited cac agent.

c. Select the category of Entity, it could be business name, limited or NGO.

D. Select annual returns

e. fill the information of the company or the RC Number of the Entity and begin the process of filing.

F. Download the online receipt from remita and submit to cac, cac approves the annual returns, keep the letter of acknowledgment of filing for records purposes.

The corporate Affairs commission made series of changes, since the passage and signing of the CAMA 2020 to an Act. if you cannot follow the above steps simply follow the alternative step.

1.Go to cac agent and ask for cac annual return form for business name,limited liability company or IT,you don”t need all of them,you only need the one concerning your business (you can contact us for this form)

2.Fill your Form and Return it to cac agent for assessment.

3.Pay the request fees for your annual return for the year.

4.CAC Agent Returns the annual return forms to cac approved by cac to you .

5. Store the approved annual return forms for the year, this is necessary in the event you need to file for changes in the future.

FILING ANNUAL RETURNS FOR COMPANY(LLC AND LLP/LP).

1.To file an annual returns for limited liability company, you need to find an accredited cac agent, the accredited cac agent takes the name of the company, the cac agent ,logs in to his portal, and in puts the name on the search bar, the name will now pop up ,the accredited cac agent will navigate to annual return, and begin to fill the online forms for your company , the entire procedure for annual return for company,whether small company or companies other than small companies are kickstarted online through an accredited cac agent portal. the cac agent will ask for information regarding the names,residential address,email address,share holdings of share holders,personal details of directors and secretary,personal details of persons with significant control of the company,please contact us for assitance.

OR in the alternative

2.Obtain cac annual returns forms for limited liability company,fill it and make sure all the directors still in the management of the company signs where necessary.

3.Attach and return the filled annual returns forms to the commission through an accredited cac agent.the cac agent will compute the fees involved and ask you to pay ,the cac agent will now begin to file for you.

4. Upon submission of the filing, the commission takes time to review your information and the status of the company.

5.Then the commission takes a decision as to whether you have complied on the annual return for the year, where you have complied, they issue you a letter of acknowledgment, please make sure you collect this letter of acknowledgment and keep for reference purpose, the letter bears the year and the receipt number from the commission.

6.The cac Accredited agent uploads the letter of acknowledgement and awaits for the commission to reactivate your inactive status on the search bar. The duration for approval of annual return takes 3-5 days or less from the commission.

7. collect your approved returns forms after the commission has approved the payment and keep for reference purpose.

this procedure can be used to file annual returns for both small company or big company annual returns.

How To File ANNUAL RETURNS With CAC ONLINE IN 2024.

Well, in 2024 filing annual returns with the Corporate Affairs Commission is now faster and easier, when compared to the previous years. it is important to note with this new method, you can file your previous years annual return,like cac annual returns of 2021, cac annual returns of 2020, cac annual returns of 2023 e.t.c ,it is advised to follow the earlier provided steps or contact us, we have filed over 150 annual returns for different entities.

HOW TO CALCULATE CAC ANNUAL RETURNS FOR BUSINESS NAME :

First you need to know the official fees of cac annual returns for business name, the official fee is N3,000 .

Under CAMA 2020, The Corporate affairs commission only allows Limited company to enjoy 18 months from the date of incorporation from filing annual returns, so Business name and incorporated trustees must file their annual return from a year after incorporation.

Note therefore that failure to file annual return within cac calendar year will attract penalty, the penalty fee is N5000 per year, the official fee for annual returns for both limited company and incorporated trustee is N5000,while default fee is also N5000.

REQUIREMENT FOR FILING ANNUAL RETURNS- first we need to inform you that to file annual return for business names, you wiill provide the following information, the following information are germane and must be submitted to an accredited cac agent:

i. Proprietors Full name and Address, Proprietors Phone number, Email address, date of birth and the identity card ,the business address, residential address and nature of business, date of birth and the BN number of the business name. this also applies for a limited liability company. we are certain that if your business name is in default of any year , the commission will require payment of the default fees, this is within the region of N5,000.00 for business names, and limited liability company categorised as small company. However the fee will be calculated differently if the company share capital is above the five million threshold for small company, the default fee for big company for annual return is N10,000.00 excluding the required annual fees of N5000 for the year being filed. the total fee for big companies in default of annual return payment is N15,000 .00 per year.

CAC REQUIREMENT FOR ANNUAL RETURN FOR INCORPORATED TRUSTEES SUCH AS CHURCH,FOUNDATION,CLUB ETC.

The corporate affairs commission requires, every incorporated trustee, such as club, foundation,mosque,church, and every non-governmental organization to file her annual return each year, between 31st June to 31st December

In doing this, the trusees information such as date of birth,identity card,residential address and national identification number shall be required.

Also the incorporated trustee shall forward their audited account for the year, they are filing the return.

Penalty for late filing of annual return for incorporated trustee: The penalty for late filing of incorporated trustee is N10,000 and the official yearly fee is N5000, total fee for the year when an incorporated trustee default is N15,000.

BENEFITS OF FILING CAC ANNUAL RETURNS- A timeous filing of cac annual returns, has alot of benefits, for your business, company or incorporated trustee, a timely filing of cac annual returns ,helps your company/business or registered organization avoid payment of penalty, accumulation of penalty can lead to much expenses when you finally decide to comply.

it is important to file your cac annual returns on time, to avoid having your company in the list of businesses, the commission have de-registered, Also note that failure to file annual return will force cac to put your business or company as INACTIVE On the cac public search .

The reason why your company or business name status is INACTIVE on the cac search result is because of non-compliance with annual return.

A timely filing of annual returns helps the commission to know that the business /company registered is still active, and every other information supplied to the commission is still valid

Filing of annual returns timely helps you have an updated annual return record, this will help you in any event your company decides to make any post incorporation changes.

FILE ANNUAL RETURNS FOR INCORPORATED TRUSTEES,IS IT NECESSARY?

Most times people ask questions whether an incorporated trustee, suppose to file an annual return? the reason for such question is that since incorporated trustees are not primarily set up for trading and profit making, they are supposed to be under the exceptions?

Under the CAMA 2004,Section 607 it provided that “The trustees of the corporation shall not later than 30th June or later than 31st day of December each year(other than the year in which it is incorporated),submit to the commission a return showing, among other things, the name of the corporation, the name ,address AND occupations of the trustees, and members of the council or governing body, particulars of any land held by the corporate body during the year, and of any changes which have taken place in the constitution of the association during the preceding year.

it is glaring what the position of the law is, for annual returns for incorporated trustees.

It is hereby advised that the deadline for payment of annual returns for 2022 ends on June 30th 2023,within this period January 1st – 30th June 2023, you are within cac calendar year for annual return filing, so cac will not calculate for default the 2022 annual return filing, but you will be in default of 2021, and other past years.

So, business names and company that wishes to file for 2022 annual return and fail to file before June 30th, 2023, will be in default for 2022 annual return filing.

PENALTY FOR LATE FILING OF ANNUAL RETURNS FOR A PARTICULAR YEAR.

The corporate affairs commission has a calendar year, accordingly late filing of annual return within a calendar year attracts penalty.

| 1 | Late filing of increase in share capital of public company | 10,000 |

| 2 | Late filing of increase in share capital of private company | 5,000.00 |

| 3 | Late filing of annual return for small company | 3,000.00 per year |

| 4 | Late filing of annual return for a private company other than a small company | 5,000.00 per year |

| 5 | Late filing of annual return for public company | 10,000 per year |

| 6 | Late filing of annual return for Company Limited by Guarantee | 5,000.00 per year |

| 7 | Late filing of statement in form of schedule 14 under section 553 | 100.00 per day for each director, company secretary and company |

| 8 | Late filing of notice of appointment of liquidator | 5,000.00 |

| 9 | Late filing of resolution for winding up | 500.00 for each director and the company secretary |

| 10 | Late filing of notice of change of company name | 5,000.00 |

| 11 | Late filing of notice in alteration of memorandum and articles of association | 5,000.00 |

| 12 | Late filing of notice/deed of release | 5,000 |

| 13 | Late filing of notice of changes in particulars of directors | 5,000.00 |

| 14 | Late filing of return of allotment by public company | 10,000.00 |

| 15 | Late filing of return of allotment by private company | 5,000.00 |

| 16 | Late filing of notice of change in shareholding | 5,000.00 |

| 17 | Late filing of notice of change in registered address | 50.00 per day for every director, company secretary and company |

| 18 | Late filing of charges by public company | 10,000.00 |

| 19 | Late filing of charges by private company | 5,000.00 |

| 20 |

Late filing of other documents (miscellaneous)

|

5,000.00 |

an individual can’t register on post.cac.gov.ng only accredited agent… but how can I register as a user and not accredited agent

Thanks for your time, but this is the correct position of things.you can ask for assitance if you need to file your annual returns.

That is not correct, please. If you are a public user, you need Entity Electronic Account before you can access the post incorporation platform and file any incorporated matter.

How much is annual return s

in any event ,let me explain, we have accredited agents account and ordinary public user account ,i would not know of the limitations,except that you cannot register a company (pre incorporation) if you intend not to be part of the directors or share holders in the company using a public user account,so in that case you need an accredited agents account) as for filing of post incorporation, an accredited agents account can be used as well as individual account of a public user.

pre and post incorporation is part of what i do,despite the fact i share information capable of making people to do it on their own.if anyone needs assistance in filing a post incorporation, i am an accredited cac agent, with alot of post and pre incorporation services successfully completed, you can reach me on 07088969065, or via my facebook handle, simply message,https://web.facebook.com/BusinessPilotWorldwide/

How does one file post incorporation documents like annual returns for NGO as an accredited agent?

Hello dear,if you are having difficulty in filing your annual returns,we can do that for you for a fee.

As a registered business name, how can I file my annual returns online?

yes,annual return for business name can be filed and payment made but you need an accredited agent portal to do this.so the commission accepts online filing of annual return.do you need assistance?

How much is the actual fee for annual return for a big company?

When is the due date for filing annual return for a company which has its year end at 31st December?

When is the Dur date for filing 2021 annual return?

The annual return fee for big companies is 5000,however note the commission looks at your net assets and annual turn over when you file your statement. do you want to file annual return ,we can assist you.

Please note that an annual return filing is not free of charge,i charge for doing it for people or business.

Have you ever considered about including a little bit more than just your articles? I mean, what you say is fundamental and all. But think of if you added some great photos or videos to give your posts more, “pop”! Your content is excellent but with images and video clips, this blog could certainly be one of the most beneficial in its field. Superb blog!

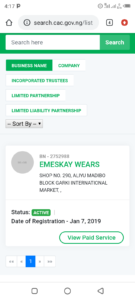

good morning my client buisness was inactive on the cac search,until i worked on the annual returns ,filed it,cac re-activated the inactive status

BN – 2924122

1207 STUDIOS30 Igbehinadun Street , ,

Status: INACTIVE (Visit CAC and update your status)

Date of Registration – Jul 10, 2019

View Paid Service

1(current)

»

Please what can I do if I lost the receipt with which I paid one of my past years Annual Returns and I have all the receipts of subsequent years?

I have a business name

For a business name (not a company) registered on 4/04/2021 when can one file the annual return and what is the deadline?

After 18 months,your annual return is due for filing.

its already due for filing