DISCOVER CREDIT CARD REVIEW :HOW TO USE IT FOR PAYMENT

Discover Credit Card Review & How to Use it for Online Payments

Discover is a digital bank known to offer top-quality banking services in the United States.

The amazing thing about the bank is that it operates everything online, as it has no branches. Yet they offer one of the best banking services and even a superb 24/7 customer care service.

Another interesting thing about Discover is their credit card, which offers cashback and rewards on almost all transactions.

Aside from that, Discover is also known for providing loan credit for businesses, private individuals, and students. Interestingly, all these are done online; there is no paper filling out or signing.

Despite being an online banking platform, Discover has earned the trust of many United States citizens. In fact, people are obsessed with banking with them. Plus, they’ve expanded their network by adding more value to their service and also dishing out premium offers to their customers.

Now let’s talk about the services they offer and their credibility.

Saving

Unlike many banks, where you pay a service or maintenance charge on your money with them. Discover offers flexible savings accounts with almost zero service fees when you perform transactions on your account.

In addition, when you save your money with Discover, it accumulates interest daily, weekly, and monthly. And your annual yield profit, which is about 2.75%, is paid to you at the end of the year.

Discover is known to be one of the few banks that offers zero minimum balance account requirements. This means you can withdraw all your money if you want to. Some other banks won’t allow you to do this.

Cashback Debit Account

With a cashback debit account, you earn cashback rewards when you shop online with a Discover debit card.

Discovers gifts up to 1% on total monthly purchases that are up to $3000 with their debit card. And if you shop more than that in a month with your card due to the $3000 limit, you will still earn a whopping $30 monthly. This means you will be getting $360 yearly by just purchasing online with your card.

Furthermore, they charge nothing for anything, be it ATM maintenance, service charges, withdrawals, deposits, bill payments, online purchases, or transaction alerts. You get to enjoy all these for free without being charged a dime.

Money Market Account

Money market accounts are one of the top services of Discover. The features are not only unique; they provide great services by providing their customers with ATMs, checkbooks, and a debit card.

It also offers high-yielding interest rates. If you save up to $100,000 in a money market account, it will yield an annual profit of 2.6 percent. And for balance that are over $100,000, the annual profit yield is up 2.70%.

In addition, money markets have no minimum account or deposit requirements and charge zero fees on all transactions. Moreso, you can earn lots of profits using a Discover money market account compared to conventional banks.

Certificates Of Deposit

Certificates of Deposit is one of Discover’s biggest offers. You get to earn lots of money by just keeping your money with them for a specific period of time.

It operates on the principle that the longer the time, the greater the addition to your interest rates, and the greater your yields. So if you are to keep your money for a long time just for the future, with Discover, you can actually make huge profits than you will with fixed deposits at brick and wall banks.

Discover’s CD account interest rates are almost the same as those of most banks, which are acknowledged to offer the highest APYs for fixed deposits.

You can invest your money here for 3 months up to 10 years.

Plus, you can opt out before the maturity date. But that will attract a penalty charge. Let’s say you wanted to keep your money with them for two years, but it’s already been a year and you want it back urgently. They will have to remove the three-month interest rate from the 12 months.

You can also open a CD ladder where you can list out flexible cashback dates so that when any of the dates you set is up, you can apply to get your money without them having to deduct penalty fees. CD accounts have a minimum deposit of $2500.

Opening a CD account can be one of the most profitable investments that you make. You don’t have to worry about your money as it’s regulated by the FDIC, so your money is insured. If, in the event of bankruptcy, you did get your money back in full.

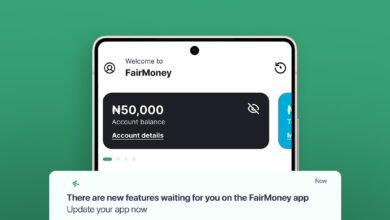

Discover Mobile App

Discover Mobile is the Discover Mobile app. It’s rated 4.9 on the App Store and 4.7 on the Play Store.

The app offers amazing features such that one can easily manage all Discover accounts in one app. Plus, you can easily log in without having to type in your password. Android users can log in with a fingerprint, and iOS users with face ID, and it works well.

Additionally, the app makes it convenient for you to view your account balance with the Quick View feature without having to log in.

ATM Service

Discover ATMs’ services are top-notch and free to use. The bank has over 60,000 ATMs across the United States. The only time you are charged for using their ATM is when you transact with a non-Discover account or card.

Downsides Of Using Discover

1. Discover has no physical branch. So in case of any issue, you are limited to contacting customer care online, which might not look satisfactory at that point for you.

2. They don’t provide auto loans.

3. Many may find it difficult to put large sums with them since they have no physical branch.

4. You are charged for out-of-service ATM transactions.

Bottom line

Discover is not like your usual brick wall bank. But it has everything you ever wanted in a bank. Their interest rates on savings beat those of many banks. In fact, Discover has achieved such a big feat that it is now rated as the 3rd biggest credit card company in the United States.

It has really been proven that banking online can be trustworthy. The interesting thing is that the bank employs transparency in its service, thus ensuring that the satisfaction of their customers is met.

Moreso, the bank charges almost nothing from you when you bank with them and even rewards you on your transactions.

Though not everyone finds it comfortable banking with a bank with only operates only online. However, using Discover might actually convince you.

Feel free to ask questions about Discover.