HOW TO CHECK YOUR BVN WITH YOUR PHONE

The business of banking and identity verification in Nigeria has now been synchronized with the unique code number issued by banks.

BVN is an abbreviation of the word Bank verification number, it was one of the innovations introduced by then president Goodluck Jonathan in 2014.

BVN is a unique number which singularizes all the profiles of an individual who owns an account with a Nigerian licensed bank.

The uniqueness of the number is that every individual, who wishes to have a corporate or personal account with the bank has one number attached to him/her.

The bank subjects the account holder to a biometric verification and data capturing, in this process the account holder is to provide the bank with the following:

I. Name

II. Residential Address

iii. Email Address

iv. Phone number

v. Date of birth

vi. fingerprint

Upon biometric capturing the bank is to issue the account holder with this number, it is usually eleven-digit number (11 digit).

The number is now attached with the account number of the holder, the bank does expect you, to furnish other banks with your bvn when the need arises.

The Bvn is a security code number, and hence should be handled carefully.

HOW TO CHECK YOUR BVN USING YOUR MTN, GLO AND 9MOBILE PHONE NUMBER

In the process of enrollment of your profile with the bank for bvn, the individual is allowed to have only one bvn account, which links it with all the bank account.

The bvn can be checked using the number you registered it with.

it is irrelevant if you are an airtel, mtn,glo,9mobile subscriber.

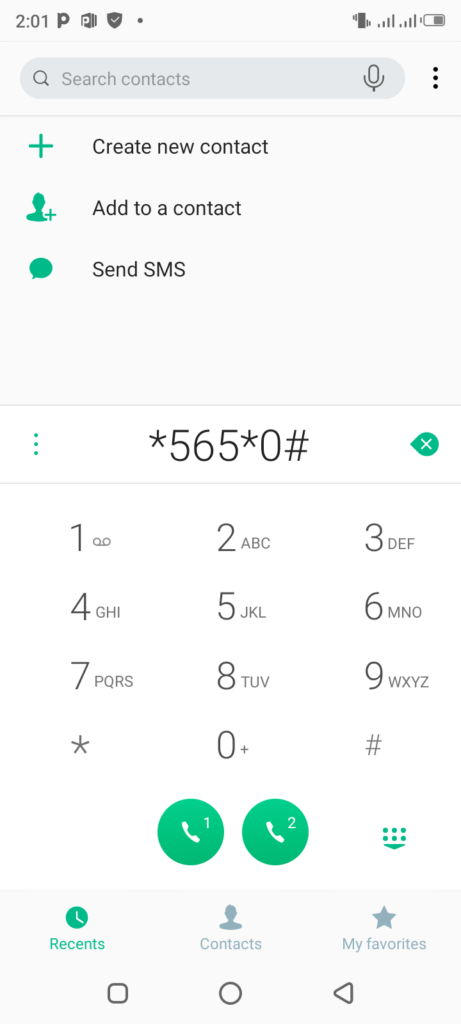

open your phone call section and input *565*phone number#

There is a service charge of N5-25 Naira attached to this service by your network provider.