HOW DO I GET SCUML CERTIFICATE?

Businesses and Companies in Nigeria are faced with the challenge of obtaining scuml certificate,for the smooth opening of their business and corporate account.

It is no longer strange to know that one of the documents required for opening and operating a corporate bank account for most businesses and companies in Nigeria is the SCUML certificate.

Well in this post , we will try and be elaborate as possible, in navigating the challenge you find with scuml certificate.

What is SCUML?

The abbreviated word above stands for Special Control Unit Against Money Laundering (SCUML) is a department carrying on their activities under the Economic and Financial Crimes Commission (EFCC), a federal governmental agency that is primarily charged with fighting corruption and fraud in Nigeria, Efcc was established in line with the Money Laundering (Prevention & Prohibition) Act 2022. This government agency is charged equally with the responsibility of solely monitoring, supervising, and regulating the activities of Designated Non-Financial Institutions (DNFIs). what are Designated Non financial institutions?

DNFI function as non-financial entities in the market, but their nature or transactions are often suspicious of money laundering and terrorist funding, the category of businesses which fall under non financial institutions are :

This is as provided in Section 25 of the Money Laundering Act in Nigeria, Designated Non-Financial Institutions include the following;

1. Dealers in Jewellery, Cars and Luxury Goods, 2. Precious Stones and Metals

3. Real Estate, Estate Developers, Estate 4.Surveyors and Valuers, Estate Agents,

5.Chartered Accountants, Audit Firms, Tax Consultants,

6.Clearing and Settlement Companies,

7. Hotels, Casinos, Supermarkets,

8.Dealers in Mechanized Farming Equipment and Machineries,

9. Practitioners of Mechanized Farming, 10.Non-Governmental Organizations (NGOs)

11. Legal Practitioners, Trust and Company Service Providers.

12. Dealers and Miners of Precious Stones and Metals

13. Pool Betting and Lottery

14. Consultants and Consulting companies

15.Construction Companies,

16. Importers and Dealers in cars and vehicles

17. Dealers in Mechanized farming equipment and machinery

18. Practitioners of mechanized farming and any other business(es) as may be designated from time to time by the Federal Ministry of Trade and Investment or SCUML.

Why is SCUML Certificate Necessary?

Fighting corporate fraud,money laundering and large-scale financial terrorism globally, is a motivating factor, in major climes, fighting terrorism sponsorship and other large corporate crimes, is of utmost importance.

The SCUML certificate is issued by the EFCC and serves as proof that companies bank account was not set up for money laundering activities and furthermore adds presumption of legitimacy on the company.

In the process of opening a business account or corporate account, a company who falls under the Designated non-financial institution, with a Cac certificate but has not registered with SCUML may not be allowed to have a bank account with any financial institution.

How to Register for SCUML:

You may obtain a SCUML certificate for your registered company through the following steps;

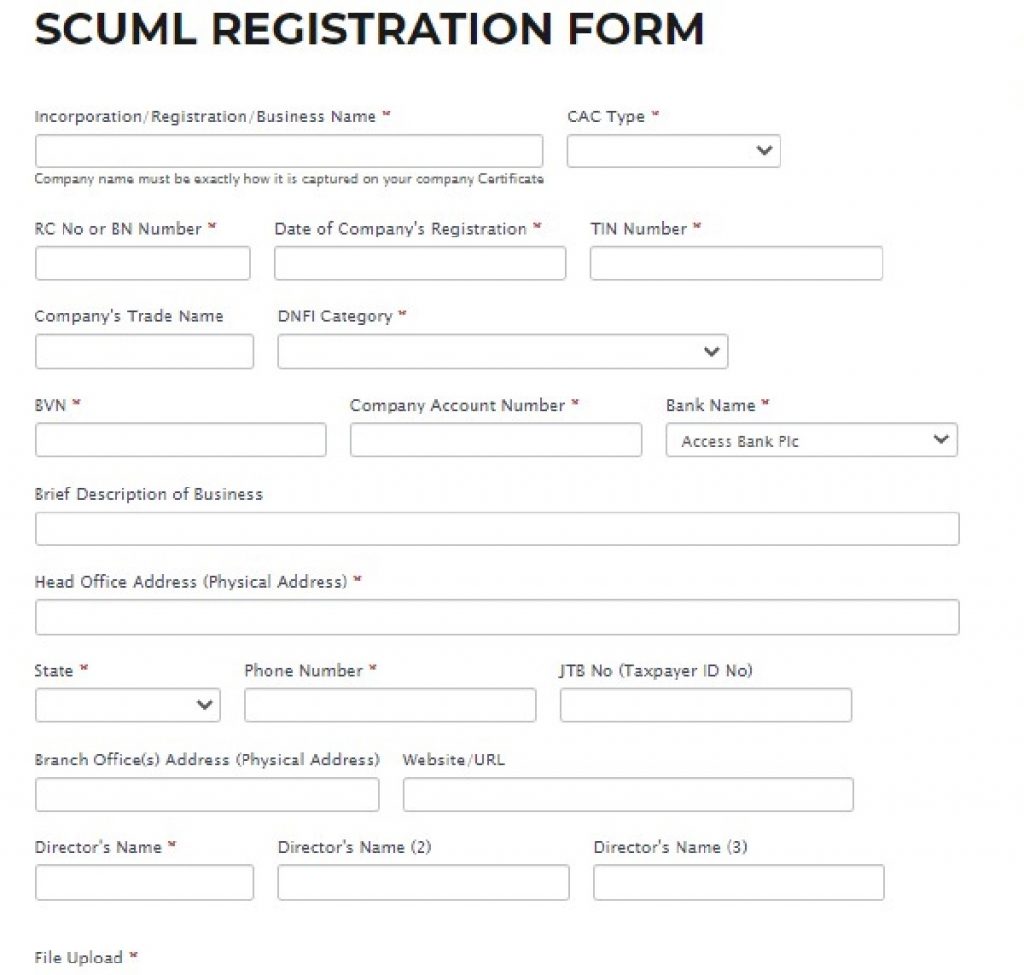

1. Fill out the SCUML registration form online (https://www.scuml.org) either by yourself or with the help of experienced agents.

2. Submit the application alongside your Nin,Bvn and incorporating documents for your company

Upon submitting the application, you will receive a notification on whether or not the application was approved or denied.

What are the Requirements for the Registration of SCUML:

The following documents are required for SCUML registration;

1. CAC incorporation documents including; Certificate of Incorporation, Articles, and Memorandum of Association

2. Bank Verification Number (BVN), Bank Name, and Account number of at least one director of the company

3. Evidence of tax registration Tax Identification Number duly processed from firs stamp duties near you.

4. Evidence of tax exemption (where applicable)

5. Authorized Operational local license (where applicable)

6. Professional certificate such as proficiency and qualifying certificate (where applicable)

7. Any other document deemed necessary

8. The Constitution of the NGO, where it is an NGO

9. For Foreign NGO ,A copy of the Agreement signed between an NGO and the National Planning Commission (applicable to International NGOs only)

SCUML certificate cost depends on alot of factors, but generally it is quite affordable, although the processing takes weeks before one gets the certificate.